🙋 Student Questions and Answers

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to robmgmte2700@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, April 20

No emailed questions

📅 Questions covered Monday, April 22

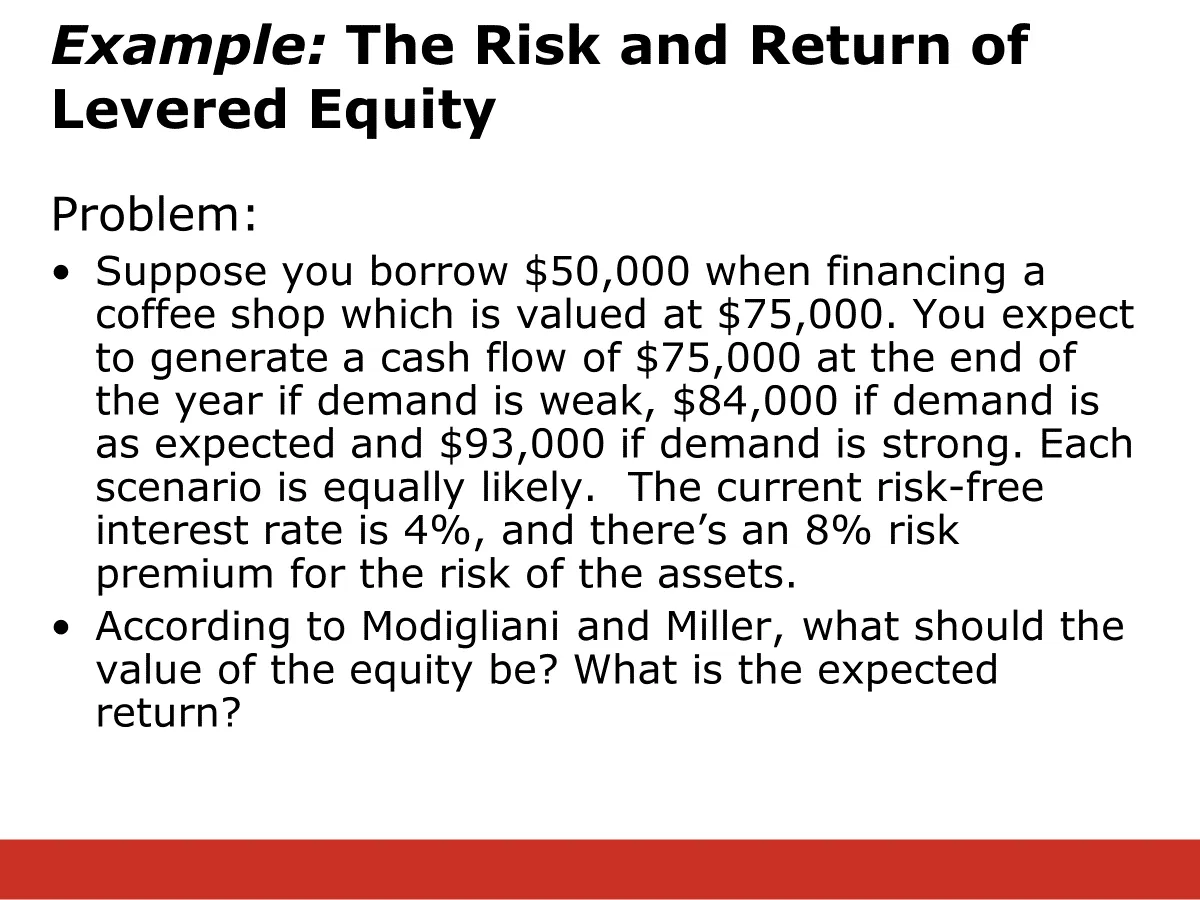

❔ I am a little confused on which rate to use in some problems. Could you go over some wording on them? For example in lecture 10, slide 28, the problem uses 12%.

✔ Because your cash flows are always at least $75,000, you are guaranteed to be able to pay back your $50,000 debt. Therefore, you can borrow at the risk free rate. According to the Corporate Finance Perspective if a firm has no debt, then all of the proceeds from the firm’s assets go to the (unlevered) equity. After all, without debt, the only claim on the firm’s assets is the equity. Therefore, the appropriate discount rate for the firm’s assets is the same as the appropriate discount rate for the unlevered equity. The problem says that the appropriate discount rate for the firm’s assets is 12%, so that is also the discount rate that you can use for the firm’s unlevered equity.

✔ Because your cash flows are always at least $75,000, you are guaranteed to be able to pay back your $50,000 debt. Therefore, you can borrow at the risk free rate. According to the Corporate Finance Perspective if a firm has no debt, then all of the proceeds from the firm’s assets go to the (unlevered) equity. After all, without debt, the only claim on the firm’s assets is the equity. Therefore, the appropriate discount rate for the firm’s assets is the same as the appropriate discount rate for the unlevered equity. The problem says that the appropriate discount rate for the firm’s assets is 12%, so that is also the discount rate that you can use for the firm’s unlevered equity.

This problem throws a curve ball because it tells you the risk premium on the assets, not the expected return.

When we covered the CAPM, he introduced risk premium:

If we algebraically solve the above for the expected return, E[rS], then we get:

Therefore, the discount rate for equity is risk prem + rF = 8% +4%

For this week’s content:

❔ The value of the firm and tax benefits increase with more leverage, but to a certain point (like slide 19 says). Same goes for increase in value as risk increases. But in some questions, it just says that it increases. Am I overthinking this?

❔ About the midterm exam. But I am not sure the questions I got wrong were the ones you sent me. Let me know if you can double check this, or if it is too much of a hassle, I’ll understand. I’m more than happy to double check this, but I’m 99.99% sure that the issue is that the question numbers are randomized for every student.

🕣8:35 ❔ Could you please go over these example problems from the lectures?

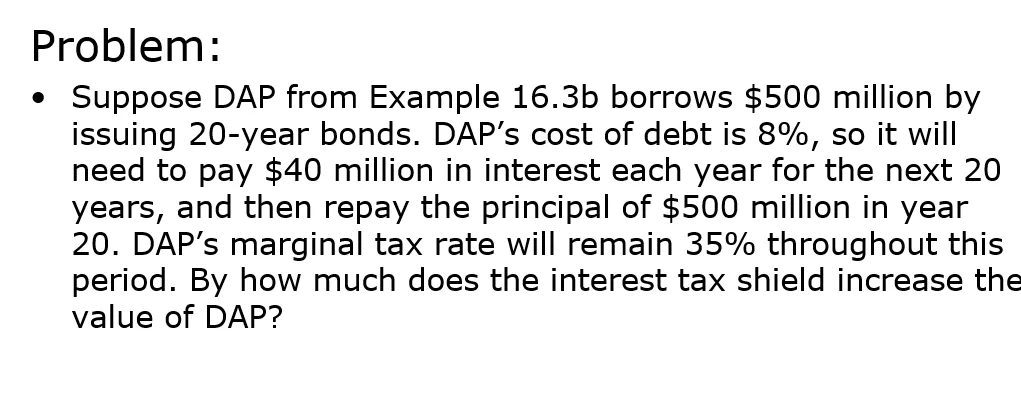

For example, the first one looks like it is using the annuity formula to solve the problem? I did not see the formula referenced in the lecture but was able to reference the formula online. Is there another way to solve this? Could you please go over this one from start to finish?

✔ Lecture 10

This is a special case. The general principal is that if you pay your interest costs every year, then your total debt will neither grow nor shrink. DAP is paying it’s interest cost every year, but no more than it’s new interset. Therefore, it’s debt stays constant at $500M.

This is a special case. The general principal is that if you pay your interest costs every year, then your total debt will neither grow nor shrink. DAP is paying it’s interest cost every year, but no more than it’s new interset. Therefore, it’s debt stays constant at $500M.

| T | D | |

|---|---|---|

| 0 | 500M | |

| 1 | 500M + 500M*8% - 40M 500M + 40M -40M = 500M | |

| 2 | 500M + 500M*8% - 40M = 500M | |

| 3 | 500M + 500M*8% - 40M = 500M | |

| 4 | 500M + 500M*8% - 40M = 500M | |

| 20 | 500M + 500M*8% - 40M = 500M |

It pays interest every year of 40M. This decreases its taxes by 40M*MTR = 40M*35%=14M.

To calculate the PV of the tax shield, you just take the PV of 20 years of the above tax shield.

You can take the PV for this 20 years either by using the annuity formula or by using Excel.

I’ll use Excel.

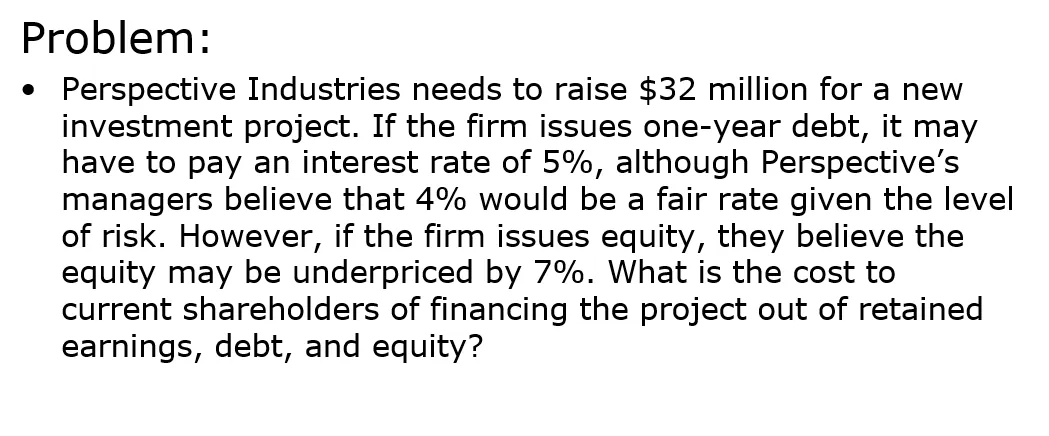

❔ For this second example, I am a little unclear how they calculated the equity portion and the thought process behind it. Could you please go over this one from start to finish?

Lecture 11

📅 Questions covered Tuesday, April 23

Lecture 3, Slide 27

🕣3:09 ❔ Could you explain this slide? I am especially confused by what the last 2 bullet points mean. I understood that in order to get 2M, Global needs to increase CF from operations by 2M. That makes sense. **But how do we suddenly jump to the logic of not having EBITA value because of additional depreciation and say it must equal 2M??? **

Problem:

- Suppose Global wants to accelerate its depreciation method so that it can generate $2 million in cash

- If its tax rate is 34%, how much additional depreciation expense would it need to generate the extra cash?

Plan:

- With a tax rate of 34%, Global’s tax bill will decrease by 34 cents for every dollar that pretax income is reduced

- In order to generate $2 million in extra cash, Global would need to increase cash flow from operations (NI + depreciation) by $2 million

- CF from operations = (EBITDA-Dep)(1-t) + Dep = EBITDA + t x Dep

- Since there’s no change in EBITDA because of additional depreciation, t x Dep must equal $2 million

✔

Your tax bill will be EBT*34% EBT = (rev - otherexpenses)

OtherExpenses = non-tax expenses.

Tax bill = EBT * 34% = (rev - otherexpenses) * 34%

If you raise your expenses by $100, then you lower your EBT by $100 because EBT = (rev - otherexpenses).

Bringing down your EBT by $100 saves you $34 of taxes, because Tax bill = EBT * 34%

Therefore, to save $34 in taxes, you can increase your expenses by $100. You may be able to see this in the formula from above: Tax bill = (rev - otherexpenses) * 34%. It suggests that when you increase your “other expenses” by $1, your tax bill will decrease by 34% of $1.

In summary, when you accelerate depreciation, your tax bill decreases by 34% of the additional accelerated depreciation that you find.: decrease in tax bill = additional depreciation × 34% Or: change in tax bill = - change in depreciation × 34%

In summary: If you increase your depreciation expense in a year by $1, then your tax bill decreases by $0.34 and your cash flow from operations increases by $0.34.

Plug and chug: 1. Equation → Δcash = ΔdepExp×MTR 2. Plug 🔌 → $2 = ΔdepExp×34% 3. Solve 🚂 → $2/34% = ΔdepExp = 5.88 4. 🧠 → They will need to find 5.88 of additional depreciation expense if they want to find $2 of additional free cash flow.

Bruce writes:

- CF from operations = (EBITDA-Dep)(1-t) + Dep = EBITDA + 34% x Dep

- Since there’s no change in EBITDA because of additional depreciation, t x Dep must equal $2 million This is similar to when I wrote: Your tax bill will be EBT*34% EBT = (rev - otherexpenses)

OtherExpenses = non-tax expenses.

Tax bill = EBT * 34% = (rev - otherexpenses) * 34%

Lecture 3, Slide 29

🕣

❔ Net income falls by 3.88M but we add back the additional depreciation of 5.88 because it is not a cash expense. Thus we do -3.88M+5.88M=2M. And it says Global’s cash balance at the end of the year would increase by 2M (the amount of tax savings that resulted from the additional depreciation deduction). **I know there is an important concept here, but I feel like I am missing out on the logic behind it. **

Example continues from above…

Execute:

- 0.34 x Dep = $2 million

- Dep = $5.88 million

- This $5.88 million decrease in pretax income would reduce Global’s tax bill by 34% $5.88 million = $2 million

- Therefore, net income would fall by 5.88 – 2 = $3.88 million

- On the statement of cash flows, net income would fall by $3.88 million, but we would add back the additional depreciation of $5.88 million because it is not a cash expense

- Thus, cash from operating activities would rise by -$3.88 + 5.88 = $2 million

- Thus, Global’s cash balance at the end of the year would increase by $2 million, the amount of the tax savings that resulted from the additional depreciation deduction

✔

Lecture 3, Slide 63

🕣 4:18 ❔ “Just because P/E ratio is high does not mean its out of wack or company is overvalued. Also, just because P/E value is low it does not mean it’s undervalued. P/E ratios can be used as a general guide BUT can also be misleading. That’s the problem”.

Can you provide a real life example of this? So how do we know if the company is undervalued?

✔

Lecture 3, Slide 64

🕣 4:22 ❔ “The higher the PEG ratio, the higher the price relative to growth, so some investors avoid companies with PEG ratios over 1”. Professor Bruce said, it can be a red flag because this can be due to herd mentality and tells us why behavioral finance is important. **So what PEG ratios can we use as reference? Is there a chart we can refer to so we can develop a sense of judgement when it comes to interpreting these numbers in real life? **

✔

Lecture 4, Slide 8

🕣 4:25 ❔

✔ Slide 8 says “Managers should separate investment and financing decisions”. Is it because investment decisions revolve around how to best allocate capital to maximize their value whereas financing decisions revolve around how to pay for investment & expenses?

Lecture 5, Slide 9

🕣

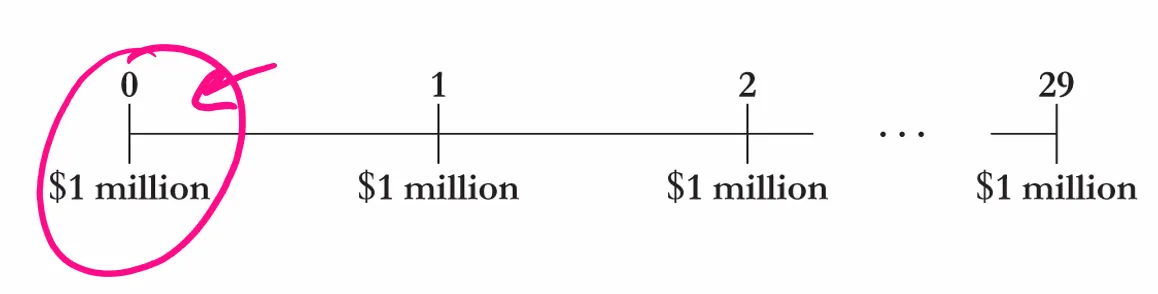

❔ Why do we add the $1M to the 11.16 for the annuity formula?

✔

Could you elaborate what it means by **“Depreciable Life” DOES NOT have to be the same as “Economic Life of the Asset”? Bruce mentioned this in his lecture. **

Lecture 5, Slide 59

🕣

❔ Step 1 was calculating corporate taxes for the new product and without the new product. The difference between the two is $6M. How does that translate to the next bullet point?—> “Because the losses on the new product reduce Kellogg’s taxable income dollar for dollar, it is the same as if the new product had a tax bill of negative $6M”.

✔