🙋 Student Questions and Answers

Click here to learn about timestamps and my process for answering questions. Section agendas can be found here. Email office hour questions to robmgmte2700@gmail.com. PS1Q2=“Question 2 of Problem Set 1”

📅 Questions covered Saturday, May 4

No questions emailed.

📅 Questions covered Sunday, May 5

Sign Convention

🕣 3:20ish

❔ Lecture 5 Sign Convention. Slide 43

✔

In general, numbers that increase the bottom line of the statement will be listed with a positive sign. Those that decrease the bottom line of the statement will be listed iwth a negative sign.

In general, numbers that increase the bottom line of the statement will be listed with a positive sign. Those that decrease the bottom line of the statement will be listed iwth a negative sign.

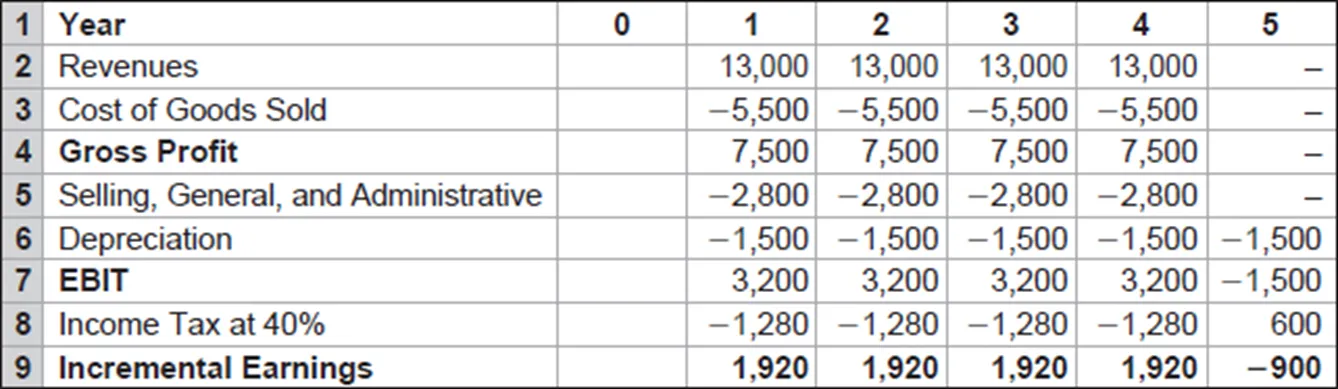

For example, on an income statement, as above, the bottom line is the incremental earnings. (While it isn’t, strictly speaking, an income statement, it’s structure is borrowed from an income statement in order to calculate incremental earnings.) Anything that increases incremental earnings will have a positive sign and anything that decreases incremental earnings will have a negative sign. Revenues, gross profit, EBIT, etc. all increases net income and incremental earnings, so they have a positive sign. However, all of the expenses (COGs, SGA, Depreciation, Tax, etc.) decrease incremental earnings, so they are listed with a negative sign.

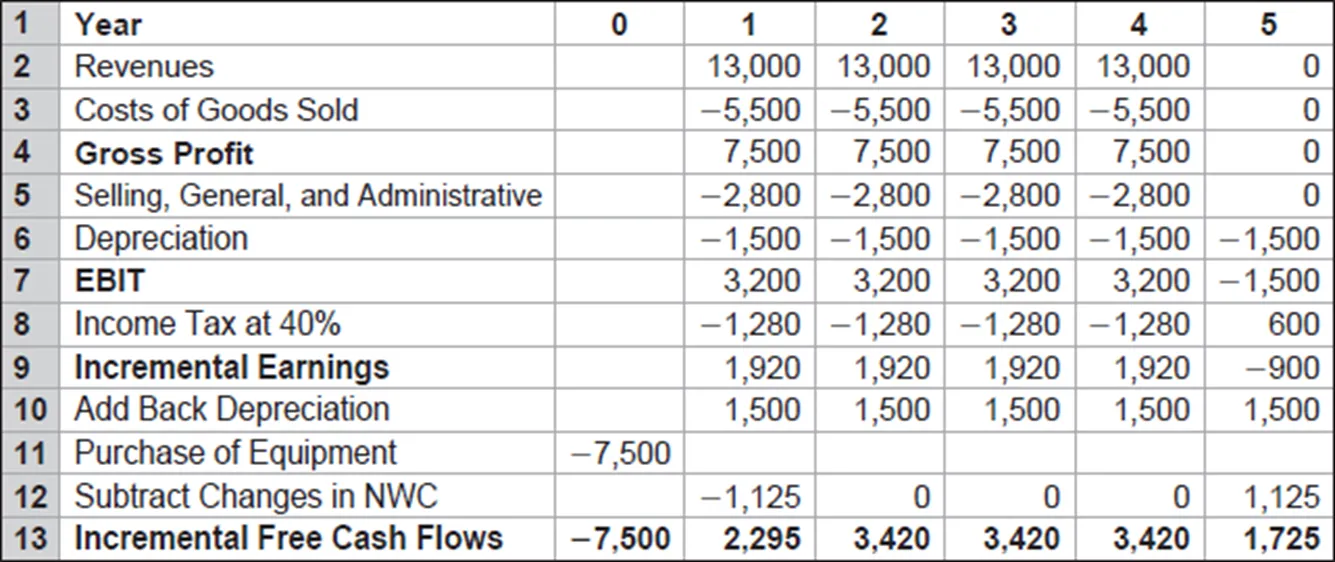

In contrast, on a statement of cash flows (or of incremental cash flows, the bottom line is the firms’ cash flows). Therefore, anything that increases cash flows will have a positive sign. Anything that decreases cash flows will have a negative sign. For example, an increase in NWC will decrease Cash Flows, so it will have a negative sign.

In the following example, you can see that capex (“Purchase of Equipmetn”) is a negative, because it implies that there is less cash flow. The hardest one to analyze is Depreciation. On an income statement, depreciation is negative, because expenses decrease earnings. On a statement of cash flows, depreciation is positive because you add in the noncash expenses. (You subtracted depreciation on the Income Statement, but you have to add it back in onthe statement of cash flows, because there was no cash outflow in a noncash expense.) Thus, Depreciation can show up with a different sign depending on whether you care calculating income or cash flows.

🕣 3:31

❔ Could we review “Problem Set 10” on M&A?

Additionally, could you demonstrate how to efficiently solve these problems using Excel?

✔ We covered this yesterday: bottom line is that PS10 had several questions that weren’t like typical exam questions. Try to not worry abotu those.

🕣 3:33

❔Is it important to know the annuity formula to calculate the Present value of the tax shield(Lecture 10 - slide 83), or is the calculation used to calculate the Present value of the tax shield for permanent debt (D*MTR))sufficient?

✔ I suspect that being able to calculate annuities in Excel is sufficient. Chances are, you won’t even use that, but you could.

Bruce’s policy is that anything in the slides is fair game. He didn’t tell me that students don’t need the annuity formula, but I doubt that he is eager to test the formula.

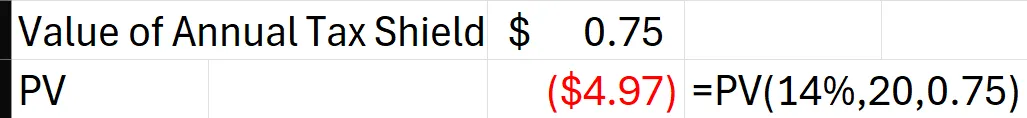

Calculations of the annuity formula can be done with the PV() formula in a spreadsheet.

✏️ Suppose that a firm has a tax rate of 25% and interest payments of $3M for the next 20 years. Assume that the firm will have enough income that it can take advantage of the tax shield provided by the interest payments. What is the present value of this tax shield? Suppose that the discount rate on its debt is 14%.

We can calculate the Present Value of this annuity using the same “PV()” formula we use for bond:

🕣3:54

❔ I have a quick question about studying for the final. While diving into Pearson and the resources offered in MyLab finance, I found a set of Sample Tests and Quizzes under the Chapter Resources tab (see attached screenshot).

Would you recommend we work on these Chapter Tests? I tried doing a couple of those, but they seem more elaborate and complex and, to some extent, include concepts we did not cover in class.

Let me know what you think. I’m reviewing all the PPTs, quizzes, and notes as I prepare for the final.

✔ You have found the key issue with these resources. Because they are based off of the textbook, they may cover material that you aren’t responsible for. Therefore, you’ll only want to use these resources carefully.

Some students do use the chapter tests, and I’m sure that they are helpful. However, I suspect most students don’t use them. You probably don’t want to use them until after you’ve studied the slides very carefully so that you know what material you’re responsibel for and what material you’re not responsible for. If you’ve studied the material well, you will be able to more quickly identify questions that are beyond the scope of this course.

🕣

❔ Could you provide examples on high-yield problems from “Lecture 5” and “Lecture 10” for extra practice? I’m trying to optimize my study time before my finals, so any advice, practice or assistance would be greatly appreciated.

✔