🔎 Understanding WACC

❔ We learned how to calculate WACC in class, but I thought that we did not hear much about what it means and where we use it. For example, in the last slide of PPT, we saw a variety of corporations’ WACC. What information can we get from them? Is the WACC lower the better or higher the better? if so, why? etc.

✔ Throughout the course, we’ve taken a discount rate for granted.

WACC is how you calculate the discount rate required by your investors for your firm.

You use the WACC when you calculate NPV of projects that you are considering taking on.

WACC is the ‘missing factor’ that is needed for an NPV analysis.

What is the WACC

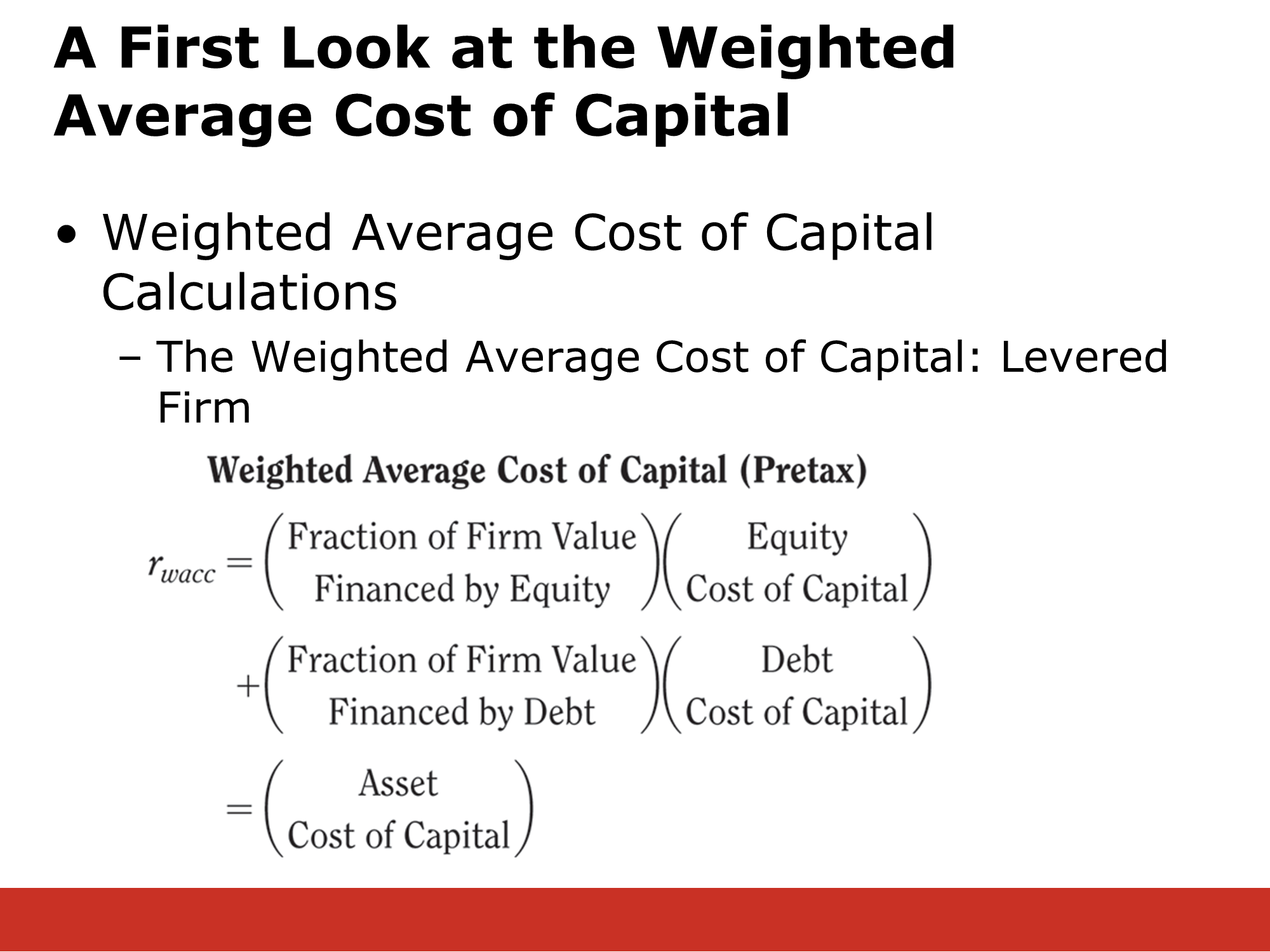

We have seen that firms use NPV to decide which projects to invest in. How do they determine the discount factor to use in their calculations. The discount rate that we use is the Weighted Average Cost of Capital.

Or, more simply, using for the weighting factors:

If your firm is financed solely by equity (unlevered), then your

If your financing structure is more complicated, you must include the costs of capital for debt and preferred as well.

When you prepare for the final, your first concern is being able to use this formula.

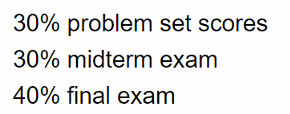

The weighted average that we use in grading is similar:

See an example →

✏️ To calculate your grade, we take a weighted average of your problem set, midterm, and final exam scores:

Suppose your PS Score is , your midterm score is , and your final is .

Suppose your scores are as follows:

| Scores | |

|---|---|

| Problem Set | |

| Midterm | |

| Final |

What is your weighted average, using the weights above?

✔ Click here to view answer

For each of the scores, we multiply those scores times the weight. The individual weights must be between and , and if you add all of the weights together, you get .

For the WACC the weights are just “The Fraction of Firm Value” financed by a given source of financing.

| 🧠 Intuition: Weighted Average ✏️ Should your “Weighted Average Cost of Capital” () be closer to or closer to ? Why? Let’s draw out the intuition of what a “Weighted Average” is. ✔ Click here to view answerYour WACC will be closer to the cost of capital of equity because your firm is funded by equity. |

Now that we’ve done the important stuff (the intuition), let’s do the calculation. The calculation will get you most of the points on the exam, but leaders should understand the intuition as well. (It also helps you remember things and work quickly through exam questions, because everything makes more sense.)

✏️ What is the WACC?

✔ Click here to view answer

Note that is of the way from to .

How do you calculate the weights? (, , )

The weights are the percentages of your financing that comes from , , or .

Consider a firm with the following market value balance sheet:

| Assets | Liabilities + Stockholder Equity |

|

| 🧠 Important Intuition: this is very helpful for understanding the equations for these weights and also the key results from two of the following lectures: M&M theorem and Mergers & Acquisitions. It’s an important part of what I refer to as “The Corporate Finance Perspective.” ✏️ If investors are willing to pay , , and for the firm’s debt, equity, and preferred equity, how much do you think they would pay for the firm’s assets as a whole? In other words, how much is the entire firm worth? ✔ Click here to view answerRecall the fundamental accounting equation: |

The value of the Assets of a firm equals the value of all claims (liabilities & equity) on those assets.

We always prefer using market value, but, occasionally, since debt markets can be opaque, we might be stuck using book value for debt.

How do you calculate ?

For the cost of capital for preferred equity, we just calculate the return on preferred equity.

Suppose I have preferred shares with a market value of and they pay a divided every year.

How do you calculate ?

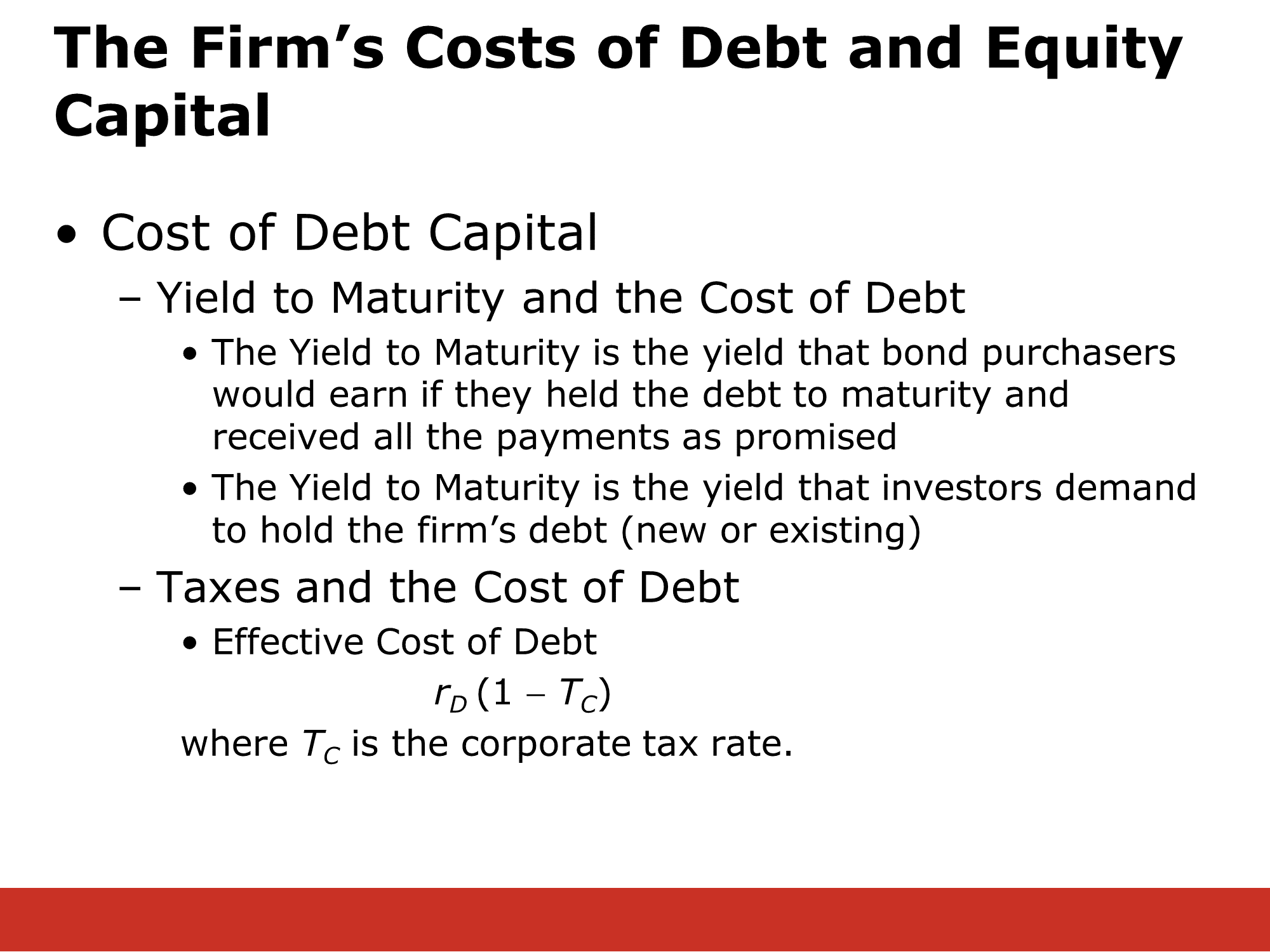

To calculate out , the cost of debt, typically, you’ll be given the or may have to calculate the using the techniques from the lecture on Debt Issuance. One key trick that can be helpful is that when any security is selling at face value (aka ‘par value’), its is just its coupon rate.

The pretax cost of capital, , is just the . However, if you have a marginal tax rate of , then when you pay of interest, you get a decrease in your taxes. Thus, the effective cost of debt is only , or of the .

Bottom line: , where is the pretax .

❔ If they are now issuing new debt at a rate but issued old debt at an unknown rate, how do we treat that unknown rate?

✔ Generally, there will only be one , so can use either debt issuance to find . Usually, you can only calculate the yield of one bond, so use that as the .

How do you calculate ?

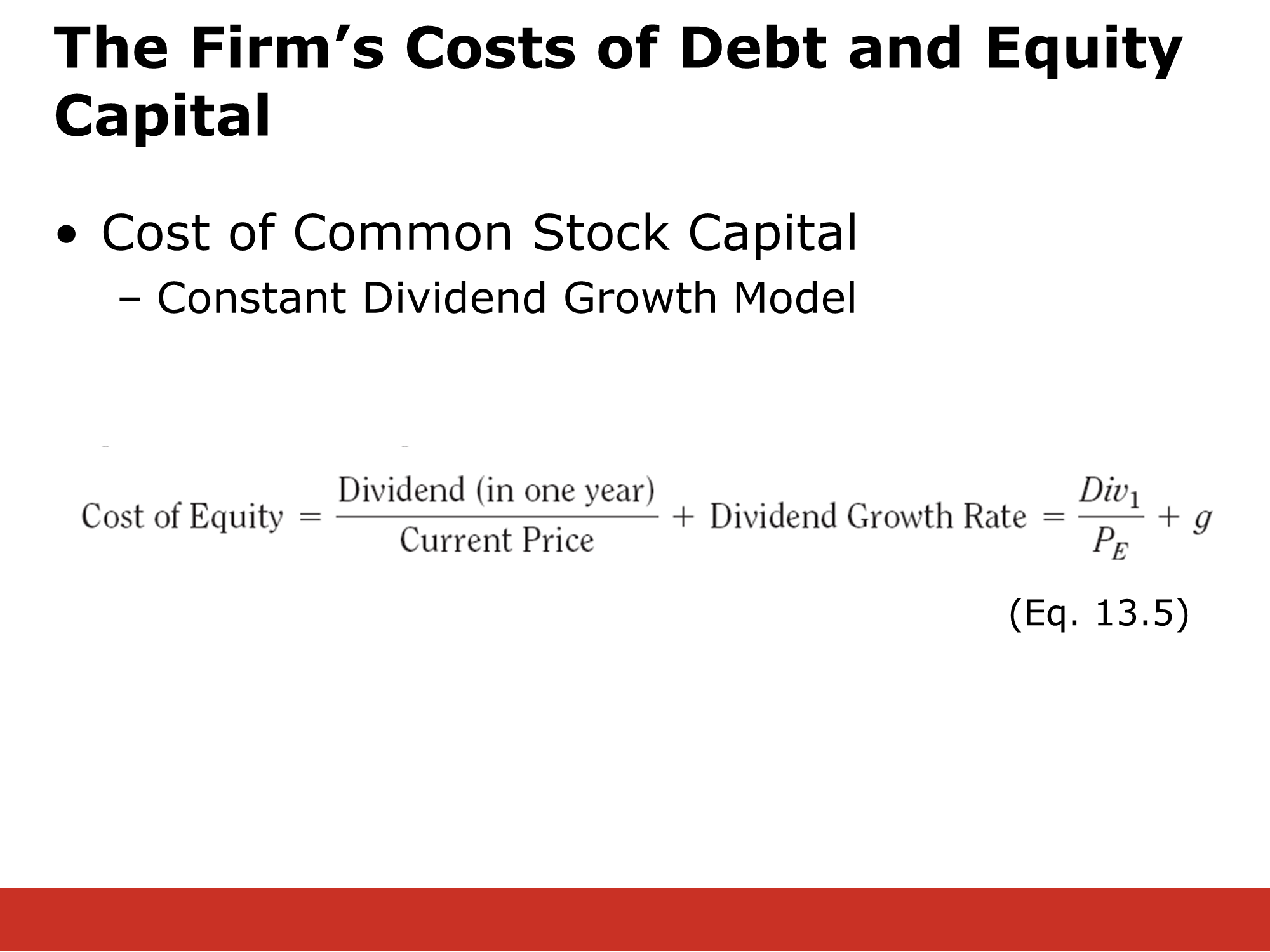

There are two ways: using the CAPM and using Constant Dividend Growth Model.

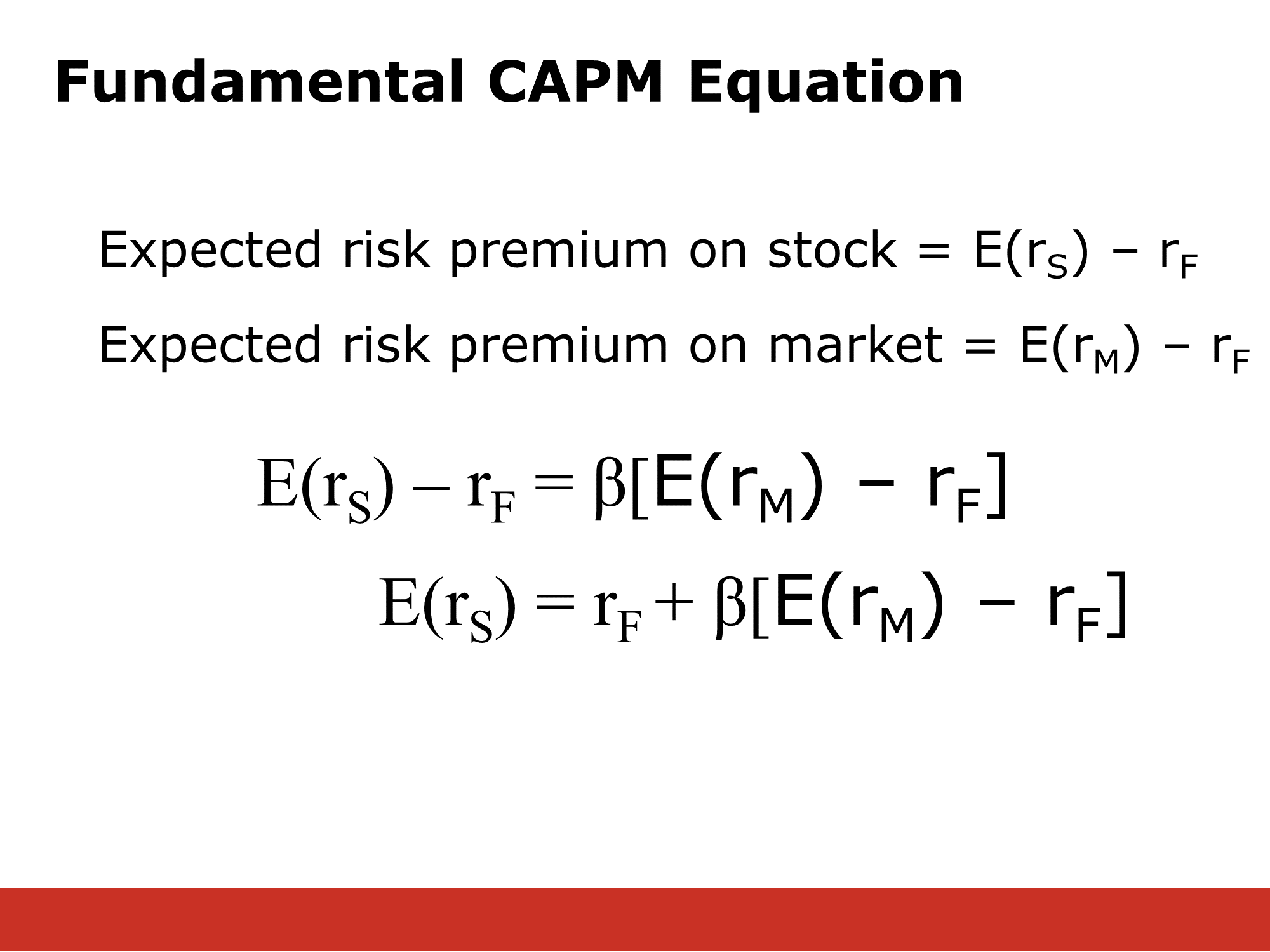

CAPM

Your formula is:

is the risk that your stock adds to a well-diversified portfolio.

is the (Expected) Excess Return of the market (portfolio) or Market Risk Premium.

Jargon hint: In general, the words “Excess” or “Premium” means that you are subtracting off , because you are looking for the premium above .

is the Expected Return of the market. Because we don’t know what the market return will actually be, we use the “Expected Return.” Expected return is defined mathematically, and you will just be given it.

Constant Dividend Growth Model