🔎 Example 22.4 - Sprint

Example 22.4 Maximum Exchange Ratio in a Stock Takeover

At the time Sprint announced plans to acquire Nextel in December 2004, Sprint stock was trading for $25 per share and Nextel stock was trading for $30 per share. If the projected synergies were $12 billion, and Nextel had 1.033 billion shares outstanding, what is the maximum exchange ratio Sprint could offer in a stock swap and still generate a positive NPV? What is the maximum cash offer Sprint could make? We can use Equation 22.4 to compute the maximum shares Sprint could offer and still have a positive NPV. To compute the maximum cash offer, we can calculate the synergies per share and add that to Nextel’s current share price.

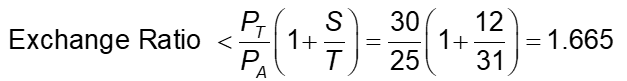

Using Equation 22.4,

That is, Sprint could offer up to 1.665 shares of Sprint stock for each share of Nextel stock and generate a positive NPV. For a cash offer, given synergies of , Sprint could offer up to .

Both the cash amount and the exchange offer have the same value. That value is the most that Nextel is worth to Sprint—if Sprint pays $41.62 for Nextel, it is paying full price plus paying Nextel shareholders for all the synergy gains created—leaving none for Sprint shareholders. Thus, at $41.62, buying Nextel is exactly a zero-NPV project.