❔ Bonds Questions and Answers

What is interest rate risk?

❔ In lecture, Bruce clearly defined credit risk as the risk that the issuer can’t service the bond (because they have a low credit rating) but I don’t have a clear definition of interest rate risk. Can you explain?

✔ Interest rate risk is the risk that you need to sell the bond before it matures and the price of the bond has dropped significantly because interest rates have risen.

Why would the bond price drop if interest rates rise? This happens because people use interest rates as the discount rate (i) when they are deciding how much they are willing to pay for a bond. When the discount rate rises, the price drops, so interest rates and bond prices are inversely related. ↑↓

When we hear “the bond market is up,” does that refer to prices or yields?

❔ When we hear the bond market is up or down or is good or bad in the news and from financial markets commentators, do they refer to the yield or the bond price ?

✔ Usually price. A “bear market in bonds” means that bond prices are falling and yields are rising.

What factors determine bond prices?

❔ Can you explain the variables that move Bond price and its dynamics briefly ( what variable is stronger ), for example is it the selling or buying pressure moving the price, or the monetarypolicy to set a certain fed fund rate target moving it, also I hear a lot thesedays about the strength of the dollar that since the world economic outlook is uncertain people tend to want more of the US dollars, does this affect bond market too since people want to get paid in interest in dollar?

✔ Yes. Historically, when there has been uncertainty in the world, there is a “flight to safety,” which means large purchases of US treasuries. In the treasury market, a main driver of the yield on any given treasury is the “average” fed funds rate over the term of the bond. For example, a main driver of the yield on the 10 year note is the average fed funds rate for the next ten years. For corporates or even munis, default risk and financial strength of the firm can drive changes in the prices of bonds. A final driver is that many bonds, particularly treasuries are used as collateral (if a hedge fund needs to borrow money or make a big bet using derivatives, it can put up a treasury bond as collateral, just like a homeowner might put up their house as collateral to borrow money), so need for collateral can affect supply and demand for bonds. (🙋That’s what caused the 1994 bond market crash - crowded trades and margin calls caused massive selling of treasuries by hedge funds and the therefore the prices to decrease)

Fed intervention is clearly very important. This gives rise to the phrase, “Don’t fight the Fed,” which means that if the Fed will be buying something, there is likely to be a bull market in the security, so you might want to buy it as well. Likewise, if the fed will be selling something, there is likely to be a bear market in the security, so you might want to sell it as well. However, since everyone knows that you shouldn’t fight the Fed, the price of the securities tends to rise immediately. This is a great example of Efficient Markets, which we will study when we cover stocks.

Are interest rates or QE more important?

❔ When we talked about monetary policy and fed fund rate, we said it affects the short term interestrate mostly but with QE we want to affect the long term interest rate, which move will have more impact on the bond market or it depends on the maturity of the bond too?

✔ Both are important. As I mentioned in the factors that drive bond prices, above, a main driver of the yield on any given treasury is the “average” fed funds rate over the term of the bond. However, there is no doubt that QE will have a large impact as well.

My tendency would be to look at it simply using supply and demand. If the Fed is buying trillions of dollars of MBS with a certain maturity and other characteristics, that will drive their price down. Likewise, if the fed is driving the Fed Funds rate down and is committing to keeping it low (aka “Forward Guidance”), then traders know that they can use arbitrage to buy the bonds. They can borrow a lot of money in the Fed Funds market and use that money to buy the MBS (this is known as arbitrage). That would also drive the price down. Whatever of the two of these leads to a larger demand response will move the bond prices more.

IRR vs Required rate of return

❔ Earlier we learned one of the definitions of interest rate can be the required rate of return (RRR). Can you explain the difference between IRR vs RRR?

✔ IRR is the actual return on any investment. It’s the effective interest rate of that investment.

RRR is the interest rate that you are hoping to earn or you are required to return. A corporation may only want to invest in projects that have a rate of return of 16% or higher. In this case, they wouldn’t invest in a project unless it’s IRR is 16% or higher.

Caveat: IRR assumes that you are able to reinvest money at the same rate. This is a weakness of IRR, so in some cases people will use alternative measures the actual “rate of return” for an investment. However, in this class IRR = “rate of return of an investment.”

IRR vs Annual Percentage Rate (APR) and Effective Annual Rate (EAR)?

❔ In your note about NPV and IRR, you mentioned “IRR tells you the effective annual return of the project, as a percentage.” Can you elaborate on the difference between Effective Annual Rate (EAR), short term rates, and Annual Percentage Rates (APR)?

✔ IRR is the effective annual rate. In e1920 we talk about interest rates for shorter periods of time and can then calculate Effective Annual Rates and APRs from those, but not in this class.

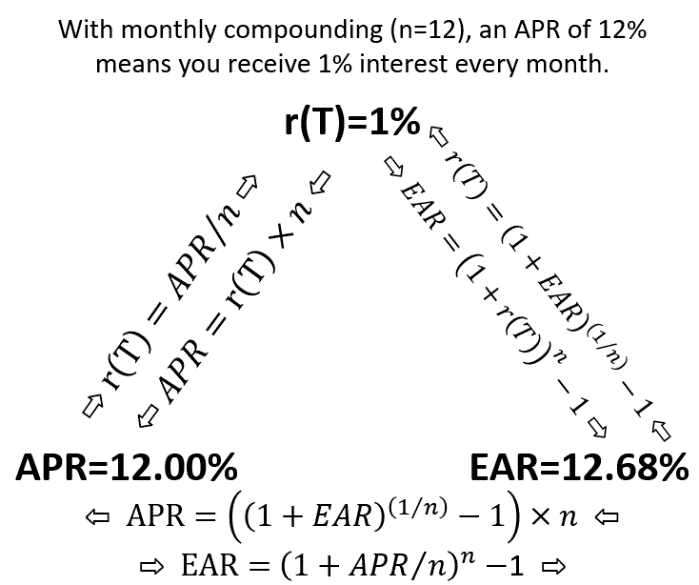

You don’t need to know the following, but the following is a graphic I made for 1920. If you want to view it, copy the graphic into another program and resize it. You’ll see it in full size!